10 Best Ways to Save Money on a Low Income

The easiest way to save money? Spend less! Living with just the basics is a powerful way to grow your savings and crush your debt.

When you approach it the right way, living frugally can feel incredibly rewarding.

We’ve gathered simple tips to help you save, cut unnecessary costs, and stick to your budget. Plus, we’ve included a few hacks to help you handle the mental side of spending less.

You’ve got this!

Free 3-Step Blueprint

3 Simple Steps to Start Earning Online

Learn how everyday people turn simple free content into real daily income using a proven 3-step affiliate blueprint.

🔒 Get the Free $600/Day Blueprint ➜Disclosure: At no cost to you, I may get commissions for purchases made through links in this post.

1. Find Ease – Live Within Your Means

Living within your means doesn’t have to be hard. It’s about spending less than you earn and making smart choices with your money.

Focus on what you really need, avoid unnecessary expenses, and prioritize saving. Once you get the hang of it, you’ll find that managing your finances feels a lot less stressful."

2. Collect Free Money

Believe it or not, there are several apps and services that offer you free money just for using them.

These platforms reward you for completing surveys, testing apps, exploring new games, and engaging in fun activities.

They’re completely free to use, easy to set up, and allow you to earn money without much effort.

Why miss out on free cash? Try these apps today and start earning rewards instantly. Here are some of our favorite platforms that we highly recommend.

Want Easy & Extra $600/Mo For Free?

Survey Junkie: Earn up to $50 per survey & $1.50 per referral. Signup here!

Myfreeapp: Get paid to play games and explore new apps.. Signup here!

⭐️ Important:Don’t forget to verify your email after signing up for Survey Junkie, Swagbucks, Myfreeapp, Scrambly and Freecash to unlock your bonuses and start earning instantly!

3. Use the Cash Envelope System

The envelope system is a game changer for your finances. It helps you control spending, stay on budget, and avoid debt.

Start by dividing your take-home pay into different spending categories like rent, utilities, groceries, and entertainment. Label an envelope for each category and put the cash you’ve set aside for that expense into the corresponding envelope.

When you need to pay for something in a specific category, just take the money from that envelope. The key is that once an envelope is empty, you stop spending in that category until the next month when you refill it.

This system keeps you accountable and helps you manage your money better!

Related reading: 10 Simple Ways to Stick to Your Budget and Make Every Dollar Count

4. Get Out of Debt

Build Savings or Pay Down Debt?

The most important thing is to have an emergency fund. Aim to save $1,000 as quickly as possible to cover unexpected expenses. Without this cushion, surprise costs can lead you to take on more debt.

Once you have that $1,000 saved, shift your focus to paying down debt. It’s tough to save when you’re losing money to interest, so tackling your debt should be a priority.

Consider using the debt snowball strategy. Start by paying off your smallest debt first. Once that’s cleared, you’ll have extra money to tackle the next smallest debt. Keep going until you’re debt-free.

After you’re free of debt and no longer paying interest, you can return to building your savings. You’ll be amazed at how quickly your money can grow without the burden of debt holding you back.

5. Understanding Your Spending

Spending can be divided into two categories: necessary spending and leisurely spending. Necessary expenses are just that—you have to spend the money.

But leisurely spending is where you can make adjustments.

To keep your leisure spending under control, give yourself an allowance. Set a budget of $X per month and spend it however you like.

Pro Tip: Let your allowance roll over! If you don’t spend all your allowance by the end of the month, add the leftover money to next month’s budget. This way, you can save up for bigger purchases without feeling restricted.

Save This PIN for Quick Access!

That way, you can easily revisit this post whenever you need it.

6. Go for Free Entertainment

Play cards, take a stroll in your local park, go for a hike, or explore books, audiobooks, music, and movies at your local library.

If you haven’t been to your local library for some time, we highly suggest you check it out.

With so many free options available, diving into books and audiobooks is a fantastic way to fill your time.

It’s an amazing opportunity to enjoy endless entertainment without spending a dime!

Much Read – 9 Easy Money Tips for Fast Investing Growth

🚀 Want to Earn While You Learn?

Join 7,000+ readers who use this free 3-step blueprint to turn online learning into predictable income.

7. Consider Downsizing for Better Savings

If you’re living on the bare minimum and still struggling to save, your expenses might be too high for your income. It could be time to consider downsizing.

Can you sell a car? Move into a smaller home? Relocate to a more affordable city?

Don’t hesitate to make a big change! Reducing your expenses can open up every financial door. With every paycheck, you’re growing your wealth. Remember, you can always upgrade in the future!

8. Boost Your Savings by Selling Unused Items

Consider selling your belongings to reach your savings goals more quickly. Listing items on Facebook Marketplace can bring in a nice chunk of cash, and you can do it in your free time.

Take a moment to look around your home and make a list of items you could sell. Check prices on Amazon to help set your prices, and feel free to use their descriptions for your online listings.

Plus, decluttering not only helps your wallet but also makes your home cleaner, more functional, and more spacious. We highly recommend trying decluttering as a strategy to grow your savings faster!

9. Stay Curious and Keep Growing

It’s fantastic that you’re exploring ways to save money on a low income. Stay curious and keep looking for opportunities to grow. Can you increase your income at work? Start a part-time business? Identify another expense to cut? Find a more cost-effective way to complete a task?

Remember, our challenges are often our best teachers. Keep an open mind, embrace the obstacles, and you’ll find yourself on the other side, grateful for the experience.

You might like – 6 Best-Paid Side Hustle Jobs To Work from Home

10. Stay Focused on the Journey

When it comes to savings goals, it can be emotionally challenging to wish they were already achieved.

Instead of fixating on the finish line, focus on the process. You’ve created a solid plan to keep your income above your expenses, so let your savings goals develop naturally.

Fill your days with productivity when it's time to work, but also allow yourself time to rest and recharge. Prioritize getting enough sleep instead of scrolling through social media late into the night.

Building a substantial savings takes time, so practice patience. Expect surprise expenses and setbacks along the way. But remember, with a plan to maintain your income over expenses, you are always moving forward.

Don’t forget to save this PIN!

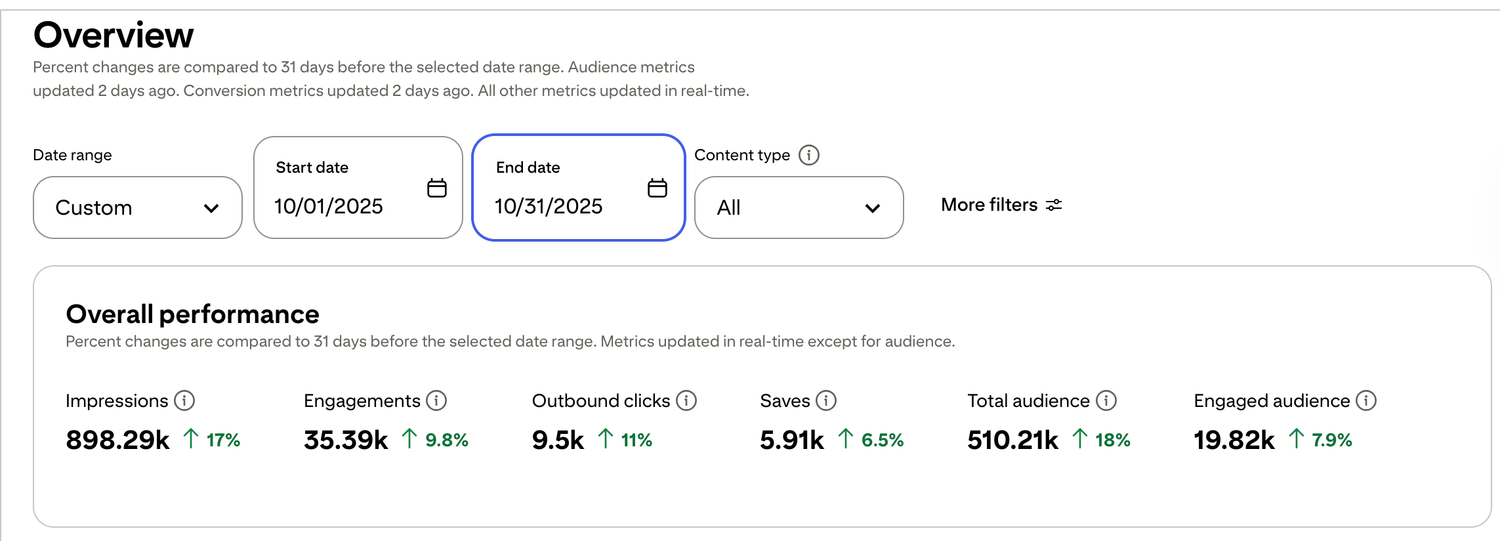

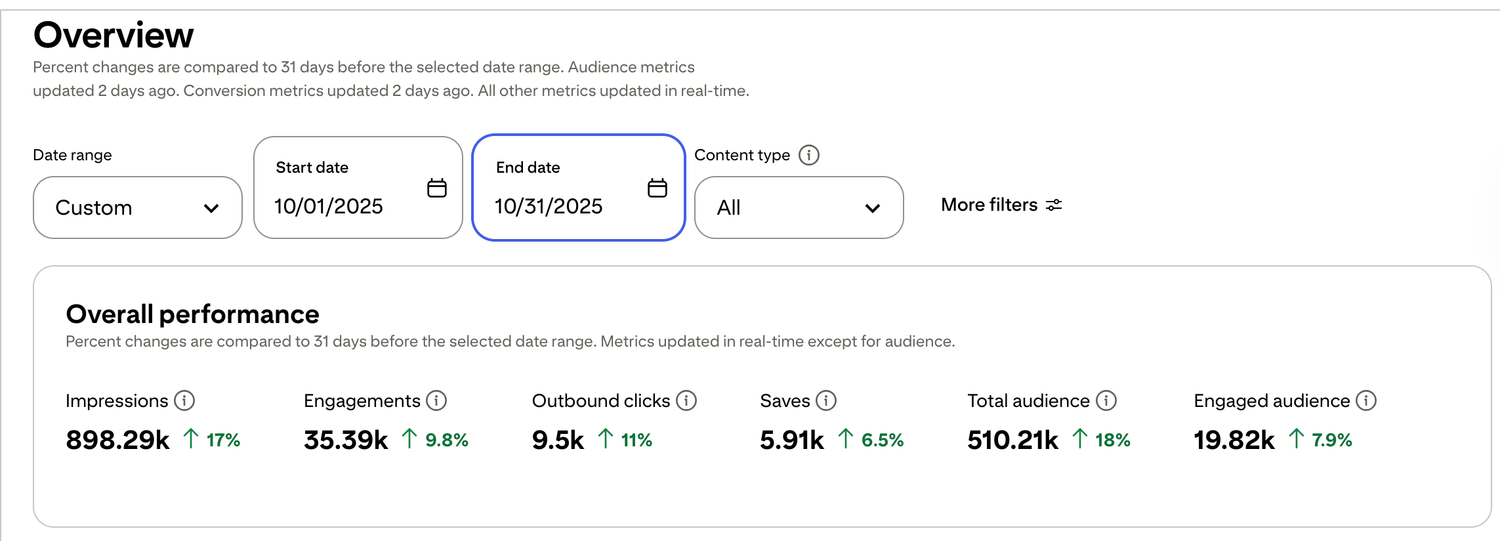

🎯 Real Results from the Blueprint

Transparent Pinterest growth backed by real analytics — the same system you’ll learn inside the free guide.

If this guide gave you a few “lightbulb” moments, you’ll love the full $600/Day Blueprint . It shows exactly how I turn simple free content into predictable daily income — step by step, with zero fluff.

🔥 7,000+ Readers Already Downloaded This Blueprint

🎯 Ready to Turn What You Just Learned into Daily Income?

Download the $600/Day Blueprint Now.

🔒 100% Secure • No Spam • 1-Click Unsubscribe

A blog offering practical tips on making money online, affiliate marketing, investing, and work-from-home jobs.

Solutions & Tips

How to Make Money Online

Investing for Beginners

Money Saving Tips